{{resourceTitle}}

{{resourceBlurb}}

{{searchResultSnippet}}

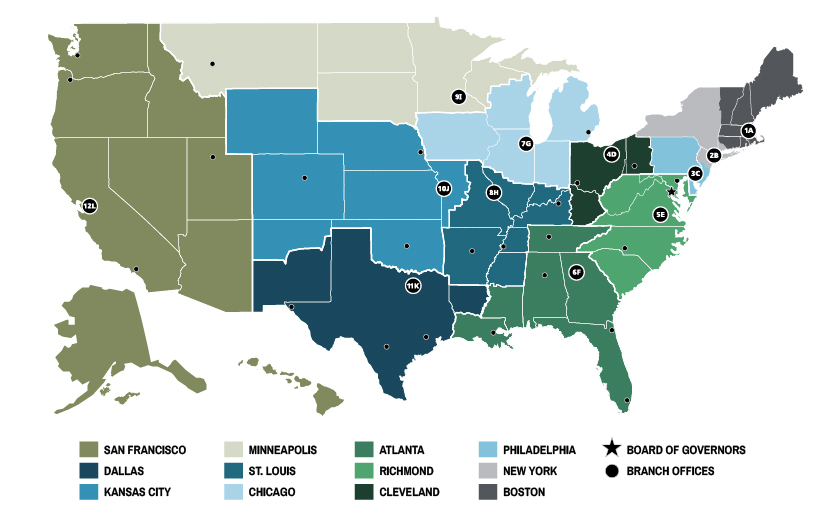

The Federal Reserve is the U.S. central bank, created by the Federal Reserve Act of 1913 to establish a monetary system that could respond effectively to stresses in the banking system. The Federal Reserve System includes

To learn more

The Federal Reserve System performs five key functions that serve all Americans and promote the health and stability of the U.S. economy and financial system.

To learn more visit: The Fed Explained: What the Central Bank Does

{{resourceTitle}}

{{resourceBlurb}}