The Fed’s monetary policymaking body, the Federal Open Market Committee (FOMC), accomplishes this “dual mandate” by gathering eight times each year (sometimes more) to discuss and set the stance, or position, of monetary policy to guide employment and prices in the desired direction.

How does the FOMC conduct monetary policy?

The Federal Open Market Committee (FOMC) conducts monetary policy by setting the target range for its policy rate -- the federal funds rate, the interest rate that banks charge each other for lending or borrowing reserve balances overnight. The federal funds rate is a key short-term interest rate that influences other interest rates in the economy.

What are the tools of monetary policy?

The Fed implements the FOMC’s policies by using its monetary policy tools to steer the federal funds rate into the FOMC’s target range. The Fed’s toolbox is composed of many tools, including three key tools with associated interest rates that are referred to as the Fed’s administered rates:

- The interest on reserve balances (IORB) rate is the interest rate that banks earn from the Fed on the funds they deposit in their reserve balance accounts. IORB is the Fed's primary tool for guiding the federal funds rate.

- The overnight reverse repurchase agreement (ON RRP) rate is the interest rate that a broad set of financial institutions can earn on deposits with the Fed. The ON RRP facility is a supplemental tool of monetary policy to help set a floor on short-term interest rates.

- The Discount rate is the interest rate charged by the Federal Reserve to banks for loans obtained through the Fed's discount window.

In addition, the Fed uses a fourth tool, open market operations, to ensure that the level of reserves in the banking system remains large enough that that small adjustments to the level of reserves do not affect the federal funds rate.

How does the Fed use its tools to steer the federal funds rate?

Because banks can always deposit their money at the Fed and earn the IORB rate, banks see the IORB rate as a reservation rate. In other words, they won’t be willing to lend their money for less than the IORB rate. Further, if banks see differences between the IORB rate and the federal funds rate – they will use arbitrage to profit from the difference. And those transactions will close any significant gap between the IORB rate and the federal funds rate.

For example, if the federal funds rate is lower than the IORB rate, banks will borrow in the federal funds market and deposit those funds at the Fed to earn a profit on the interest rate differential. The increase in demand for funds in the federal funds market will pull the federal funds rate higher. These transactions will continue until any significant gap between the IORB rate and the federal funds rate is closed.

If the federal funds rate is higher than the IORB rate, banks will withdraw funds from the Fed and lend in the federal funds market to earn the higher return. The increase in supply of funds in the federal funds market will push the federal funds rate lower. These transactions will continue until any significant gap between the IORB rate and the federal funds rate is closed. So, when the Fed raises or lowers the IORB rate, arbitrage ensures that the federal funds rate will increase or decrease as well.

How might the Fed use monetary policy to stimulate a weakening economy?

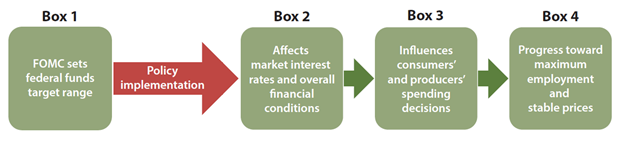

Suppose the economy weakens and employment falls short of maximum employment. Meanwhile, the inflation rate, which might have recently been steady around 2 percent, is showing signs of decreasing. The Fed might decide to use expansionary monetary policy to provide stimulus for the economy. The flow diagram below can be used to describe how the Fed conducts expansionary monetary policy, and how those policy changes impact the economy.

Box 1: The FOMC will conduct policy by decreasing the target range for the federal funds rate.

Red arrow: To implement the FOMC’s policy change, the Fed would decrease its administered rates—interest on reserve balances rate, overnight reverse repurchase agreement offering rate, and discount rate—accordingly.

Box 2: Because the administered rates are reservation rates, and because banks and other institutions arbitrage across investment options, lowering the administered rates pushes the federal funds rate and other market interest rates lower. These lower market interest rates make borrowing money more affordable.

Box 3: Lower interest rates decrease the savings rate and the cost of borrowing money, which encourages consumers to increase spending on goods and services and businesses to invest in new equipment.

Box 4: The increase in both consumption spending by consumers and investment spending by businesses increases the overall demand for goods and services in the economy. With increased production, businesses are likely to hire additional employees and spend more on other resources, which moves the economy toward the Fed’s maximum employment goal.

In short, lower interest rates can be used to stimulate a weak economy back, moving it toward the Fed’s dual mandate.

How might the Fed use monetary policy to cool an economy that is overheating?

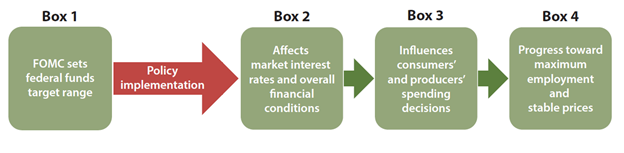

Suppose the economy is growing at a very fast rate; inflation has been above the Fed’s 2 percent target for a considerable time and is rising. At the same time, the unemployment rate is very low. In this case, the Fed might decide to use contractionary monetary policy to bring inflation back to the Fed’s goal of averaging 2 percent over time. The flow diagram below can be used to describe how the Fed conducts contractionary monetary policy, and how those policy changes impact the economy.

Box 1: The FOMC will conduct policy by increasing the target range for the federal funds rate.

Red arrow: To implement the FOMC’s policy change, the Fed would increase the administered rates—interest on reserve balances rate, overnight reverse repurchase agreement offering rate, and discount rate—to steer market rates toward the FOMC’s target.

Box 2: Because the administered rates are reservation rates, and because banks and institutions arbitrage, raising the administered rates pushes the federal funds rate and other market interest rates higher. These higher interest rates make borrowing money more costly.

Box 3: Higher interest rates increase the cost of borrowing money and make saving more advantageous, which discourages consumers from spending on some goods and services and reduces businesses’ investment in new equipment.

Box 4: The decrease in both consumption spending by consumers and investment spending by businesses decreases the overall demand for goods and services in the economy. With decreased demand for goods and services, upward pressure on wages and prices dampens. As these changes transmit to the broad economy, inflationary pressures diminish, and the inflation rate will fall back toward 2 percent.

In short, higher interest rates can be used to restrain inflation and move the economy back to the Fed’s dual mandate.

Additional Resources

External LinkThe Fed Explained: Conducting Monetary Policy

External LinkPage One Economics: The Fed’s New Monetary Policy Tools